HIGHLIGHTS

-

Acquisition of 279koz Au Wudinna Gold Project approved by vendor shareholders1

-

Barton now has binding rights to project ownership pending tenement grant or transfer

-

Barton total South Australian JORC Mineral Resources now 2.14Moz (78.9Mt @ 0.85g/t Au)

ADELAIDE, AUSTRALIA / ACCESS Newswire / July 24, 2025 / Barton Gold Holdings Limited (ASX:BGD)(FRA:BGD3)(OTCQB:BGDFF) (Barton or Company) is pleased to announce completion of its rights to acquire the Wudinna Gold Project (Wudinna) from Cobra Resources PLC (Cobra). Cobra shareholders have approved the Transaction at a general meeting held yesterday, 24 July 2025 in the UK. Following this approval, Barton now has binding rights to ownership of Wudinna, and will work with Cobra to facilitate transfer of the Sale Assets to Barton, and Final Settlement.

Commenting on the acquisition of Wudinna, Barton Managing Director Alexander Scanlon said:

“We are pleased to obtain Cobra shareholder approval for Barton’s acquisition of the Wudinna Gold Project. Wudinna is a highly valuable addition to Barton’s South Australian gold platform, which is now over 2Moz and set to grow further with the pending re-estimation of the Challenger underground mine.

“With this transaction approved, we will now continue our evaluation of opportunities to integrate Wudinna into our long-term regional development objectives. These assets offer significant optionality given our professional capabilities and planned future infrastructure. We look forward to sharing updates as we advance this project.”

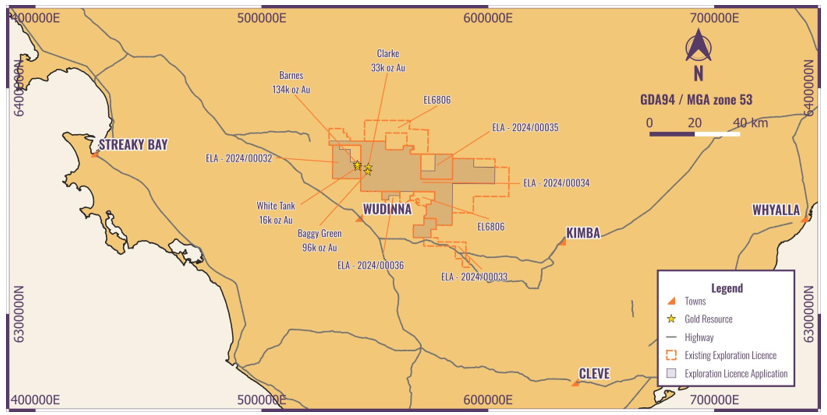

Wudinna Gold Project JORC Resources

The Wudinna Gold Project is comprised of the Barns, White Tank, Clarke and Baggy Green Deposits hosting a combined JORC (2012) Mineral Resources Estimate (MRE) of 279,000oz Au (5.81Mt @ 1.5 g/t Au).2

|

Deposit |

Classification |

Tonnes (Mt) |

Grade (g/t Au) |

Gold Ounces |

|

Barnes |

Indicated |

0.44 |

1.3 |

18,000 |

|

Inferred |

2.19 |

1.6 |

116,000 |

|

|

White Tank |

Inferred |

0.33 |

1.5 |

16,000 |

|

Baggy Green |

Inferred |

2.12 |

1.4 |

96,000 |

|

Clarke |

Inferred |

0.73 |

1.4 |

33,000 |

|

Total |

5.81 |

1.5 |

279,000 |

Table 1 – Wudinna Gold Project September 2023 JORC (2012) Mineral Resources Estimate2

Key terms of acquisition

The Wudinna acquisition was agreed on compelling terms for Barton, and in a framework of significant mutual benefit to each of Barton and Cobra. Cobra’s shareholders will continue to hold a gold exposure through Barton and its considerably larger regional gold development platform, and each of Barton and Cobra will focus on their respective areas of development interest, gold and rare earths (respectively).

Barton has paid to Cobra a non-refundable deposit of $50,000 cash, with further consideration to be paid subject to Completion and Final Settlement as summarised in Table 2 below:2

|

Agreement signing |

New Tenements3 |

Final Settlement |

Total |

|

|

Cash |

$50,000 |

$150,000 |

$300,000 |

$500,000 |

|

Barton shares4 |

$800,0005 |

$4,200,0005 |

$5,000,000 |

|

|

Total |

$50,000 |

$950,000 |

$4,500,000 |

$5,500,000 |

Table 2 – Wudinna Gold Project acquisition consideration payable2

Barton will also pay to Cobra certain contingent benefits, including:2

-

Upon definition of a JORC MRE over 500koz gold, $2,000,000 worth of Barton Shares;6

-

A Production Benefit up to $7.5m cash ($50/oz Au) which Barton can buyback for 50% of its value;7

Other key terms of acquisition include:2

-

All Barton shares issued pursuant to the Transaction will be subject to 1 year’s escrow (for 40% of them) and 2 years’ escrow (for 60% of them) from their respective dates of issue (Escrow); and

-

Cobra’s dealing in any Barton shares will be subject to an Orderly Market Agreement granting Barton a first right to facilitate their sale to Barton’s nominees at a fixed discount of 7.5% to their 20 trading day volume weighted average price (VWAP);

Barton and Cobra will now complete an Escrow Agreement and the Orderly Market Agreement, pursuant to which the tranche of $800,000 worth of Barton shares will be issued following New Tenements issue.5

Barton will provide further updates as the Transaction proceeds toward Final Settlement.

1 Refer to ASX announcement dated 2 July 2025; capitalised terms in this document have the same meaning as defined in that document

2 Refer to ASX announcement dated 2 July 2025; capitalised terms have the same meaning as defined in that document

3 Cobra has the right to acquire the Exploration Licenses over which the ELAs have been issued pursuant to Section 30AA of the South Australian Mining Act (Original Tenements). If the New Tenements are not granted, the Parties may pursue the issue of new Exploration Licenses (and Final Settlement) through an application for subdivision of the Original Tenements in favour of Barton for those areas representing the Sale Assets or, if this is unsuccessful, Barton shall have the right to elect to either (a) take the Original Tenements in lieu, or (b) terminate the Transaction.

4 All Barton Shares issues pursuant to the Agreement will be issued pursuant to Barton’s ASX Listing Rule 7.1 capacity.

5 Number of Barton shares calculated by reference to VWAP for the 30 trading days up to, but not including, the Agreement date, being approximately $0.78 / Barton share as of the close of business on Friday, 27 June 2025.

6 Number of Barton shares calculated by reference to VWAP for the 30 trading days up to, but not including, the Exploration Milestone date.

7 Number of Barton shares calculated by reference to VWAP for the 30 trading days up to, but not including, the Production Benefit buyback date.

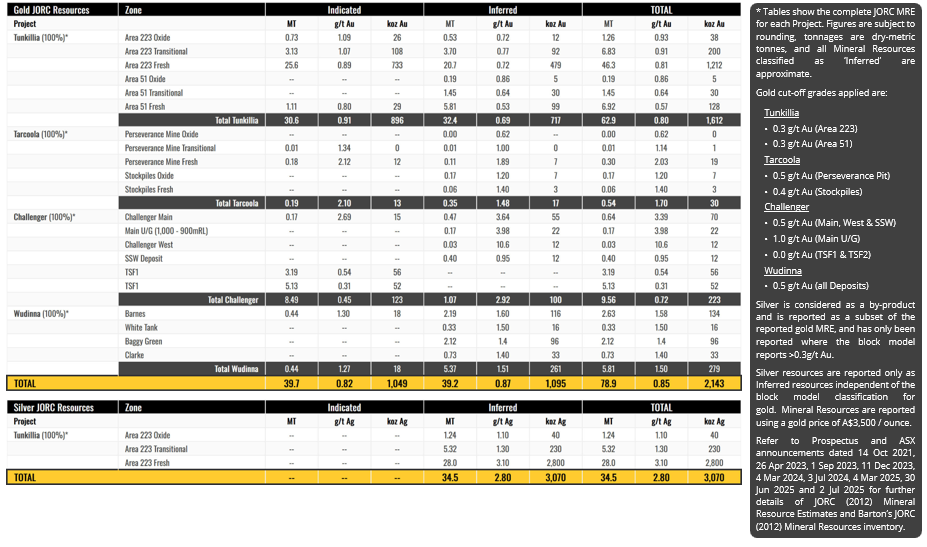

Updated Company JORC Mineral Resources Statement

Further to the MRE for the Wudinna Gold Project detailed in this announcement:*

-

Barton’s total JORC (2012) Mineral Resources Au endowment is now 2.14Moz (78.9Mt @ 0.85 g/t Au); and

-

Barton’s total JORC (2012) Mineral Resources Ag endowment is now 3.10Moz (34.5Mt @ 2.80 g/t Au).

Authorised by the Board of Directors of Barton Gold Holdings Limited.

For further information, please contact:

|

Alexander Scanlon |

Jade Cook |

Competent Persons Statements

The information in this announcement that relates to the estimation and reporting of the gold Mineral Resource estimates for the Barns, Baggy Green and White Tank Deposits has been compiled by Mrs Christine Standing BSc Hons (Geology), MSc (Min Econs), MAusIMM, MAIG. Mrs Standing is a Member of the Australian Institute of Geoscientists and the Australian Institute of Mining and Metallurgy and is a full-time employee of Snowden Optiro (Optiro Pty Ltd) and has acted as an independent consultant. The information in this announcement that relates to the estimation and reporting of the gold Mineral Resource estimate for Clarke has been compiled by Ms Justine Tracey BSc Hons (Geology), MSc (Geostatistics), MAusIMM. Ms Tracey is a Member of the Australian Institute of Geoscientists and is a full-time employee of Snowden Optiro (Optiro Pty Ltd) and has acted as an independent consultant.

Mrs Christine Standing and Ms Justine Tracey have sufficient experience with the style of mineralisation, deposit type under consideration and to the activities undertaken to qualify as Competent Persons as defined in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (The JORC Code). Mrs Standing and Ms Tracey consent to the inclusion in this announcement of the contained technical information relating the Mineral Resource estimations in the form and context in which it appears.

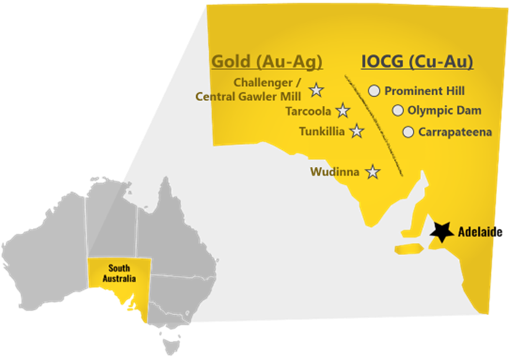

About Barton Gold

Barton Gold is an ASX, OTCQB and Frankfurt Stock Exchange listed Australian gold developer targeting future gold production of 150,000ozpa with 2.1Moz Au & 3.1Moz Ag JORC Mineral Resources (78.9Mt @ 0.85 g/t Au), brownfield mines, and 100% ownership of the region’s only gold mill in the renowned Gawler Craton of South Australia.

|

Challenger Gold Project

Tarcoola Gold Project

Tunkillia Gold Project

Wudinna Gold Project

|

|

Competent Persons Statement & Previously Reported Information

The information in this announcement that relates to the historic Exploration Results and Mineral Resources as listed in the table below is based on, and fairly represents, information and supporting documentation prepared by the Competent Person whose name appears in the same row, who is an employee of or independent consultant to the Company and is a Member or Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM), Australian Institute of Geoscientists (AIG) or a Recognised Professional Organisation (RPO). Each person named in the table below has sufficient experience which is relevant to the style of mineralisation and types of deposits under consideration and to the activity which he has undertaken to quality as a Competent Person as defined in the JORC Code 2012 (JORC).

|

Activity |

Competent Person |

Membership |

Status |

|

Tarcoola Mineral Resource (Stockpiles) |

Dr Andrew Fowler (Consultant) |

AusIMM |

Member |

|

Tarcoola Mineral Resource (Perseverance Mine) |

Mr Ian Taylor (Consultant) |

AusIMM |

Fellow |

|

Tarcoola Exploration Results (until 15 Nov 2021) |

Mr Colin Skidmore (Consultant) |

AIG |

Member |

|

Tarcoola Exploration Results (after 15 Nov 2021) |

Mr Marc Twining (Employee) |

AusIMM |

Member |

|

Tunkillia Exploration Results (until 15 Nov 2021) |

Mr Colin Skidmore (Consultant) |

AIG |

Member |

|

Tunkillia Exploration Results (after 15 Nov 2021) |

Mr Marc Twining (Employee) |

AusIMM |

Member |

|

Tunkillia Mineral Resource |

Mr Ian Taylor (Consultant) |

AusIMM |

Fellow |

|

Challenger Mineral Resource |

Mr Ian Taylor (Consultant) |

AusIMM |

Fellow |

|

Wudinna Mineral Resource (Clarke Deposit) |

Ms Justine Tracey |

AusIMM |

Member |

|

Wudinna Mineral Resource (all other Deposits) |

Mrs Christine Standing |

AusIMM / AIG |

Member / Member |

The information relating to historic Exploration Results and Mineral Resources in this announcement is extracted from the Company’s Prospectus dated 14 May 2021 or as otherwise noted in this announcement, available from the Company’s website at www.bartongold.com.au or on the ASX website www.asx.com.au. The Company confirms that it is not aware of any new information or data that materially affects the Exploration Results and Mineral Resource information included in previous announcements and, in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates, and any production targets and forecast financial information derived from the production targets, continue to apply and have not materially changed. The Company confirms that the form and context in which the applicable Competent Persons’ findings are presented have not been materially modified from the previous announcements.

Cautionary Statement Regarding Forward-Looking Information

This document may contain forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “expect”, “target” and “intend” and statements than an event or result “may”, “will”, “should”, “would”, “could”, or “might” occur or be achieved and other similar expressions. Forward-looking information is subject to business, legal and economic risks and uncertainties and other factors that could cause actual results to differ materially from those contained in forward-looking statements. Such factors include, among other things, risks relating to property interests, the global economic climate, commodity prices, sovereign and legal risks, and environmental risks. Forward-looking statements are based upon estimates and opinions at the date the statements are made. Barton undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained herein. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income and performance) are based upon the best judgment of Barton from information available as of the date of this document. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. Any reliance placed by the reader on this document, or on any forward-looking statement contained in or referred to in this document will be solely at the readers own risk, and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof.

* Refer to Barton Prospectus dated 14 May 2021 and ASX announcement dated 25 July 2025. Total Barton JORC (2012) Mineral Resources include 1,049koz Au (39.7Mt @ 0.82 g/t Au) in Indicated category and 1,095koz Au (39.2Mt @ 0.87 g/t Au) in Inferred category, and 3,070koz Ag (34.5Mt @ 2.80 g/t Ag) in Inferred category as a subset of Tunkillia gold JORC (2012) Mineral Resources.

Cautionary Statement RegardingWudinna Gold Project MRE

The resource estimates contained herein were prepared in accordance with the JORC (2012) Code by the Competent Persons for Cobra Resource PLC in 2023. The information has not materially changed since it was last reported. Nothing causes Barton to question the accuracy or reliability of the Competent Persons estimates. Barton accepts the quoted estimates and the Competent Persons view that the resource classification appropriately reflects the deposit’s knowledge level. It is possible that following evaluation and/or further exploration work the currently reported estimates may materially change and hence need to be reported afresh under and in accordance with the JORC (2012) Code. Barton has not independently validated the former owner’s estimates and is not to be regarded as reporting, adopting, or endorsing those estimates.

Full disclosures are required to comply with ASX’s “Mining Report Rules for Mining Entities: See Frequently Asked Questions” FAQ 37 (Appendix 1) .

APPENDIX 1

Additional Information in terms of ASX Mining FAQ 37 regarding the Wudinna Gold Project MRE. This material has also been previously published by Barton – refer to ASX announcement dated 2 July 2025.

|

Obligation under Question 37 |

Answer |

|

The estimates have been reported by the former owner rather than the acquirer; |

|

|

State the source and date of the reporting of the estimates – the announcement must attach a copy of the original report of the estimates of Mineral Resources or Ore Reserves by the former owner or state the location where the report can be viewed by interested readers; |

|

|

Which edition of the JORC Code they were reported under and the fact that the reporting of those estimates may not conform to the requirements in the JORC Code 2012; |

|

|

The acquirer’s view on the reliability of the estimates, including by reference to any of the criteria in Table 1 of the JORC Code 2012 which are relevant to understanding the reliability of estimates (in the case of Ore Reserves, the acquirer must specifically comment on the continuing reliability 19/22 of the applicable Modifying Factors, including the Economic Modifying Factor used by the former owner); |

|

|

A summary of the work programs on which the estimates were based and a summary of the key assumptions, mining and processing parameters and methods used to prepare the estimates; |

|

|

Any more recent estimates or data relevant to the reported mineralisation available to the entity; |

|

|

What evaluation and/or exploration work that needs to be completed to report the estimates as Mineral Resources or Ore Reserves in accordance with the JORC Code 2012; |

|

|

The proposed timing of any evaluation and/or exploration work that the acquirer intends to undertake and a comment on how the acquirer intends to fund that work; |

|

|

A statement by a named Competent Person(s) that the information in the market announcement provided is an accurate representation of the available data and studies for the material mining project; |

|

|

A cautionary statement proximate to, and with equal prominence as, the reported estimates stating that:

|

|

|

The announcement is not otherwise misleading. |

|

8 Refer to ASX announcement dated 27 May 2025

SOURCE: Barton Gold Holdings Limited

View the original press release on ACCESS Newswire